New Delhi [India], November 22:India’s economy is undergoing transformative shifts driven by demographics, policy changes, and rapid digitalization. As China faces ongoing economic uncertainties, global investors are increasingly turning to India as a preferred investment destination, a trend highlighted by Morgan Stanley. While Indian public markets have delivered significant growth since 2020, attention has shifted toward private market opportunities, including unlisted shares and pre-IPO investments, attracting interest from both global allocators and domestic investors.

Despite this robust activity, investing in the private market remains complex, with challenges such as limited transparency and fragmented data complicating decision-making processes.

Challenges faced by investors in India

Krishna Patwari, Founder and Managing Director of Wealth Wisdom India Pvt. Ltd. (WWIPL.com), highlights several challenges that undermine investor confidence in private market investments and lead to uninformed decisions:

- Lack of Structure: Unlike the organised and regulated public markets, private markets lack a cohesive structure, making it difficult for investors to track the performance of individual companies or the private firms they have invested in.

- Limited Transparency: The absence of transparent platforms for monitoring market trends poses a significant risk. Investors often remain unaware of critical concerns and struggle to identify promising opportunities aligned with evolving market dynamics.

- Information Overload: Identifying reliable resources amidst a flood of information is a persistent challenge. While the abundance of options and free resources benefits modern investors, navigating through conflicting opinions and separating facts from noise can make research overwhelming.

The challenges of navigating the private market ecosystem underscore the need for streamlined access to insights and tools that support informed decision-making. Addressing this need, Wealth Wisdom India Private Limited (WWIPL) has introduced the Primex 40 Live Private Markets Index—a purpose-built platform designed to simplify and enhance investment tracking in the intricate landscape of private market investments.

Primex 40 Live Index

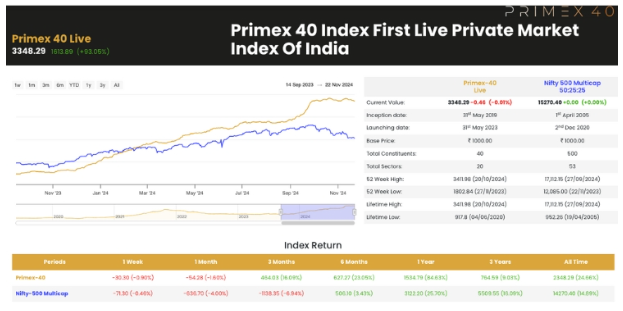

The First Live Private Market Index of India – Primex 40 Index, was created to serve as a standard metrics to evaluate the performance of Indian private companies. The index comprises businesses with a strong financial record, a track record of development and profitability, and a position as leaders in their respective industries.

What Sets the Primex 40 Index Apart?

The Primex 40 Index provides valuable insights into the performance of India’s top unlisted shares and delisted companies, offering data from May 31, 2019, onward. It is benchmarked against the Nifty 500 Multicap 50:25:25 index, covering a broad range of sectors. The index tracks performance across various timeframes, from the past week to all-time records, allowing investors to assess trends and make comparisons. Calculated in real-time, the index uses a market capitalization-weighted methodology, meaning companies with higher market caps have a more significant influence on the index’s performance.

Investors can utilize the Primex 40 Index to track the performance of key private equity players and gain valuable insights into the broader private market landscape.

PRIMEX Index Methodology: Key Features

The PRIMEX Index selects companies based on their trading history in the unlisted share market, share availability, sector dominance, and number of public shareholders. This ensures that the index represents companies with established market presence, sufficient liquidity, sector diversity, and public investor interest.

The index weights each company using both the total market cap and free float market cap, with the average market cap reflecting overall market value and the free float market cap focusing on shares available for public trading.

A 10% weight cap is applied to each company to prevent excessive concentration, promoting diversification and minimizing risks tied to any single company.

Once a company lists publicly, it is promptly removed from the index, ensuring the focus remains on unlisted companies in India. New companies are added based on selection criteria, capturing emerging firms with growth potential in the unlisted market.

The index is rebalanced quarterly to maintain accuracy. Rebalancing also occurs in response to corporate actions such as Listing, Buyback, mergers, Demergers, acquisitions, or Reduction in Capital, which impact market capitalization and free float.

Why Use PRIMEX for Tracking Your Private Market Investments

The Primex 40 Index plays a crucial role in assisting investors to track their private market investments. Krishna Patwari explains that it is an essential tool for navigating the complexities of private market investments and mitigating associated risks. The key benefits of the Primex 40 Index for investors include:

- Benchmarking Performance:The Primex 40 Index aggregates the performance of select companies, providing investors with a reliable reference point to compare their investments. This enables more informed decision-making and clearer performance evaluation.

- Risk Mitigation and Diversification:By including companies from a range of sectors, the Primex Index helps address risks and enhances diversification. This approach reduces the risks tied to individual investments and offers a more balanced exposure across various segments of the private market.

- Tracking Market Trends:The index allows investors to track the performance of their private market investments, providing insights into market trends. It highlights sectors experiencing growth while identifying areas of concern, allowing investors to stay informed and responsive.

- Performance Measurement:The Primex Index enables investors to measure the success of their private market investments against a standardised benchmark. By comparing returns to the index, investors can assess the effectiveness of their strategies and make adjustments as necessary.

Krishna Patwari further adds, “Primex 40 offers a unique and essential tool for tracking private market investments. This index serves as a valuable benchmark for evaluating private market performance, showcasing a carefully selected group of industry leaders recognized for their growth, liquidity, and market capitalization. The methodology behind the index ensures that the data and resources used are reliable, providing investors with accurate insights. However, it’s important to note that the index itself is not intended as a recommendation to buy, sell, or hold any securities or investments. Investment decisions should be made after thorough research, analysis, and consultation with qualified financial advisors. Since the value of investments can fluctuate, it’s crucial to assess one’s financial situation and risk tolerance before making any investment decisions.”

Given the complex and fluctuating nature of the market, the Primex 40 Index provides investors with a valuable platform for tracking and analyzing private market investments. With thorough research and careful consideration, investors can maximize their potential for more successful outcomes and enhanced returns.

Disclaimer

The information contained in this website is for general information purposes only. The information is provided by BhaskarLive.in and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of BhaskarLive.in We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, BhaskarLive.in takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

For any legal details or query please visit original source link given with news or click on Go to Source.

Our translation service aims to offer the most accurate translation possible and we rarely experience any issues with news post. However, as the translation is carried out by third part tool there is a possibility for error to cause the occasional inaccuracy. We therefore require you to accept this disclaimer before confirming any translation news with us.

If you are not willing to accept this disclaimer then we recommend reading news post in its original language.