APSEZ, also called Adani Ports and Sez is an integrated port infrastructure company that operates multiple ports along the Indian coastline. Port maintenance, sophisticated transportation infrastructure and maintaining a maritime trade ecosystem fall under the domain of the Adani Group conglomerate.

The Adani Group controls 6 major ports in India with 2 located in Gujarat and the rest located in Odisha, Goa and Andhra Pradesh.

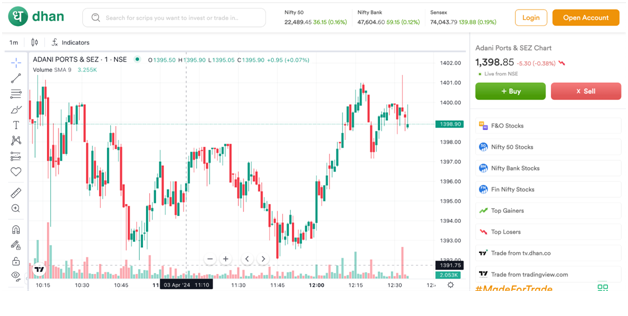

The stock of this port infrastructure company has surged 92% in the past year, outpacing the Nifty’s 50 benchmark. Read on to learn more about the company’s performance.

Adani Ports and Sez Financial Analysis

The table given below includes some of the factors based on which you can decide how strong or weak a share can get in the future. EBITDA stands for Earning Before Interest, Taxes, Depreciation and Amortization and is a representation of a company’s financial performance.

The growth trajectory of APSEZ seems promising as the firm aims to achieve EBITDA in the range of Rs 14,500- Rs 15,000 crore in the financial year 2024.

Here are other key performance indicators mentioned below.

| Category | March 2023

(In Crores) |

March 2022

(In Crores) |

| Gross Revenue From Operations | 5159.88 | 4146.80 |

| Total Operating Revenue | 5237.15 | 4206.22 |

| Total Revenue | 8235.94 | 6725.53 |

How Risky Is It For New Investors to Buy APSEZ Shares?

A sustained growth across several years indicates long-term success which makes APSEZ an attractive trading option. However, market fluctuations and global economic trends can affect share prices.

According to the Adani Ports share price chart, the trend of purchasing a share is upwards. Owing to the TTM P/E ratio being 28.80, 10 analysts give the share a strong buy rating whereas 7 have given a strong buy rating. APSEZ also has a 65.89% promoter holding and 34.11% public holding.

Experts further mention that the stock of this port infrastructure company has surged 92% in the past year, outpacing a 30% gain in the Nifty 50.

Although the firm lost its momentum post the release of the Hindenburg report, it is now back in the game. Within two weeks of the release of the group, the market value of the group dropped to Rs 6.7 lakh crore from Rs 19.2 lakh crore. However, the market cap has now risen to Rs 14.5 lakh crore.

Following a 24% surge in cargo volumes during the financial year of 2024, Adani Ports and SEZ is expected to exceed its revised full year cargo volume target of 400 million tonnes.

Predicted Price Target of Adani Ports Share Price:

In the past 1 year, the stock soared 92% surpassing Nifty 50. Owing to the surge in cargo volumes, analysts are predicting continued growth. Adani Ports share price is expected to range between Rs 1,560 and Rs 1,600 as per the leading stock market analysts.

Conclusion

Based in Ahmedabad, the Adani Group is one of the most rapidly expanding business portfolios. The interests span logistics including seaports, shipping and airports along with public transport infrastructure and energy.

Disclaimer

The information contained in this website is for general information purposes only. The information is provided by BhaskarLive.in and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of BhaskarLive.in We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, BhaskarLive.in takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

For any legal details or query please visit original source link given with news or click on Go to Source.

Our translation service aims to offer the most accurate translation possible and we rarely experience any issues with news post. However, as the translation is carried out by third part tool there is a possibility for error to cause the occasional inaccuracy. We therefore require you to accept this disclaimer before confirming any translation news with us.

If you are not willing to accept this disclaimer then we recommend reading news post in its original language.