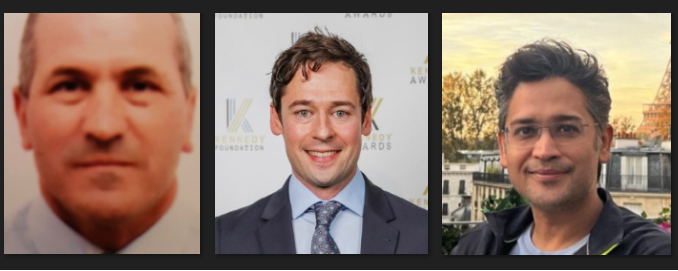

Somiphos is Algeria’s state-owned phosphate mining company and Amit Gupta is the owner of Agrifields DMCC, a fertilizer and phosphate trading company based out of Dubai.

According to Sydney Morning Heralds’ award-winning investigative journalist Nick McKenzie, Amit Gupta is an “alleged corporate crime kingpin and fugitive from justice” who “has built a global business worth an estimated $800 million.”, who had “had backed a political coup on the small Pacific Island of Nauru by bribing multiple politicians who had plotted to topple the government.”

In 2020, “the AFP moved to seize multiple properties and bank accounts connected to Gupta in Australia, Singapore and New York worth an estimated $200 million.” Gupta faced an attempted extradition from the Australian government in 2023 and currently faces a global travel ban due to an Interpol Red Notice issued against Gupta. Gupta is unable to leave his base of Dubai.

Nick McKenzie, who has been twice named the Graham Perkin Australian journalist of the year, states “Banking records suggest Gupta’s companies also paid suspected bribes to senior Algerian officials for mining concessions in Africa”.

The Somiphos Scandal:

Amit Gupta has extensive business dealings with Somiphos, also known as SocieteDes Mines De Phosphate or Ferphos, in Algeria, which this revelation is linked to. Somiphos, the state-owned phosphate company, has the majority of its business dealings tied with Amit Gupta of Agrifields DMCC.

What is shocking is how a state-owned company conducts business with an individual who is under criminal investigation for bribing government officials, including the former President, justice minister and present-day President of the Republic of Nauru, according to ABC.

Amit Gupta also faces charges like money laundering, fraud, accounts manipulation, forgery by authorities, including the Australian Federal Police and Indian police.

Furthermore, according to the Sydney Morning Herald, “The US documents name Getax director Amit Gupta as the ‘target of a criminal investigation who is alleged to have conspired with others to bribe foreign public officials and to have engaged in money laundering and other offences’.” and that “In 2018, Singaporean anti-corruption authorities fined Getax Singapore S$80,000 for bribery”.

However, the Somiphos Scandal, is much larger than this. You can click on the text to view the documents obtained, which is cited.

Amit Gupta’s former company, Getax, was purchasing approximately 600,000 tonnes of rock phosphate from Somiphos annually. They bought rock phosphate at significant discounts to market rate, likely costing the Algerian state-owned company hundreds of millions of dollars over its relationship. How was Gupta able to do this? Through the same strategy he allegedly used in Nauru, bribing public officials and employees.

Let us pay a closer look into the details of the Somiphos Scandal through newly unveiled documents:

#1 Bribed official: Amara Charaf-Eddine

Position: Ferphos/Somiphos Director of Development

Details: Getax had paid fees of around $1 per tonne to the Ferphos/Somiphos Director. Amara is now the Chairman of Madar Holding and President of UNEP. (View Amara following up for hispayments)

Banking records: Banking records show a Gupta-controlled entity paying US$53,019.36 on 13th November 2009 from its ABN Amro bank account to Mr. Amara Charaf-Eddine and another banking record shows US$50,000 transferred to him on 20th January 2010, for “consultation fees” and “payment against vessel of Khadiza Jahan” respectively to Charaf-Eddine’s beneficiary account /152475877270 at HSBC Singapore. (View Amara confirming bank details on email)& (View 2 Amara bribe transfers)

The entity that paid the money is Hi-Tech and it’s signatory and controller is Amit Gupta, as per its company records. (View signatory document).

Email records show the compensation structure for Charaf-Eddine being accepted by Getax officials as follows:

Monthly payment of US$5000

All travel, lodging, entertainment costs covered.

US$1 per tone in success fees, translating to approximately US$600,000 a year.

(View email of Getax accepting Charaf-Eddine bribery structure)

An email record shows Mr. Charaf Eddine working to advance the Gupta’s interests, by giving them strategic advice to ensure that his exclusivity remains in place, including wanting to find a solution that is “convenient to Getax and protects (Mr. Z) as well. (We need him inside)”, and to write a letter to “Ferphos/Somiphos” and to “Mention that Getax can go Legal” to which Charaf-Eddine goes onto say, “The Minister will react” and that “Ferphos don’t like legal procedures. They will react positively”, ensuring Getax gets the “best price” and “preferential treatment”, according to Mr. Charaf Eddine’s own words. (View Charaf-Eddine’s email).

#2 Bribed official: Lakhdar Mebarki

Position: Former President/CEO of Ferphos/Somiphos.

Banking records: Banking records show Getax Australia Pty Ltd paid US$56,500 on 4th December 2007 to Lakhdar Mebarki. Furthermore, Lakhdhar accepted kick-backs in the name of his brother Salim Mebarki and a lady named Svitlana Mebarki, under various descriptions including commissions and market introduction fees for rock phosphate. The banking records show US$1 per tone being paid, which translates to US$600,000 annually. Some bank transfers obtained show at least US$300,000 (in a mix of currencies of USD, AUD and EUR) paid in kickbacks between 4th December 2007 and 27th January 2009 directly from Getax Australia Pty Ltd. (View 23-pages of Mebarki bribe bank transfers).

#3 Bribed official: Bouraouri Bekhouche

Position: Chief of Commercial of Somiphos/Ferphos

Banking records: Bank transfers show Getax Australia transferred US$48,000 to Berkhouche on 23rd March 2007 and US$20,000 on 23rd July 2007. Berkhouche also received US$0.5 per tonne in kickbacks, translating to US$300,000/annually. (View Berkhouche two bribe transfers).

Berkhouche also emailed Getax officials to direct payments to his USD bank at Bank of New York and his EUR account at Fortis Bank in Brussels. (ViewBerkhouche email)

According to the Australian Broadcasting Corporation (ABC), when “the world price rose to almost $400 in 2008, Getax was paying as little as $43 per metric tonne.” This would likely be enabled through its channels of bribing senior officials in Somiphos/Ferphos.

On that basis, this would have cost the state-government and thus taxpayers of Algeria, shipping 600,000 tones, up to US$214.2 million, in earnings, in 2008 alone, or 28.683 billion Algerian Dinars.

The relationship between the Gupta’s and Somiphos has stretched nearly two decades, and is now conducted through Agrifields DMCC and Agrifields FZE, two entities owned and controlled by Amit Gupta.

According to Sydney Morning Herald, “Agrifields DMCC” is “the name of the global fertiliserfirm Gupta launched after fleeing Australia.”

This year alone, in under 8-months, Indian customs documents obtained shows that Agrifields shipped at least 364,210 metric tones from Somiphos Algeria to India. This brings in, at least, 7.5 billion Algerian dinars in sales for Gupta. (View shipment documents here)

The total number, however, is likely higher than this figure, as his company reportedly ships to other ports.

The enduring relationship between Amit Gupta and Somiphos/Ferphos is alarming, casting severe doubt on the company’s integrity.

Despite Gupta’s documented legal issues facing multiple criminal charges globally, including bribery and corruption, Somiphos continues to deal with Gupta. This ongoing association not only undermines ethical standards but also suggests a troubling indifference to transparency and accountability in managing state-owned resources.